Machine Learning for Fraud Detection in Apps : A Comprehensive Guide

Machine learning for fraud detection in apps is revolutionizing how businesses combat fraudulent activities, offering sophisticated solutions that traditional methods struggle to match. By leveraging advanced algorithms and data analysis techniques, machine learning models can identify patterns and anomalies indicative of fraud, providing enhanced security and protection for both users and businesses.

Why Use Machine Learning for Fraud Detection?

Traditional rule-based systems often fall short in detecting complex and evolving fraud schemes. Machine learning, on the other hand, adapts to new patterns and learns from data, enabling it to identify subtle indicators of fraud that might otherwise go unnoticed. Here are several compelling reasons to implement machine learning in your app’s fraud detection system:

- Improved Accuracy: Machine learning models can analyze vast amounts of data to identify fraudulent activities with greater accuracy than traditional methods.

- Real-Time Detection: Machine learning enables real-time monitoring and detection of suspicious transactions, preventing fraud before it occurs.

- Adaptability: Machine learning models can adapt to evolving fraud techniques, ensuring continuous protection against new threats.

- Scalability: Machine learning solutions can easily scale to accommodate growing transaction volumes and user bases.

- Reduced False Positives: By learning from data, machine learning can minimize false positives, reducing unnecessary disruptions to legitimate users.

Key Machine Learning Algorithms for Fraud Detection

Several machine learning algorithms are particularly well-suited for fraud detection. Each algorithm has its strengths and weaknesses, making it crucial to choose the right one based on the specific needs of your app. Below, we explore some of the most popular and effective algorithms:

Anomaly Detection Techniques

Anomaly detection algorithms are designed to identify data points that deviate significantly from the norm. These techniques are particularly useful for detecting unusual transactions or behaviors that could indicate fraud. Common anomaly detection algorithms include:

- One-Class SVM: This algorithm learns a boundary around normal data and flags any data points outside this boundary as anomalies.

- Isolation Forest: Isolation Forest isolates anomalies by randomly partitioning the data. Anomalies, being rare, require fewer partitions to be isolated.

- Local Outlier Factor (LOF): LOF measures the local density deviation of a given data point with respect to its neighbors, identifying outliers based on their relative isolation.

Supervised Learning Methods

Supervised learning algorithms require labeled data (i.e., data that has been pre-classified as fraudulent or non-fraudulent) to train a model. These models can then be used to predict the likelihood of fraud for new, unseen data. Popular supervised learning algorithms include:

- Logistic Regression: A simple yet effective algorithm for binary classification problems, predicting the probability of a transaction being fraudulent.

- Decision Trees: Decision trees create a tree-like structure to classify data based on a series of decisions.

- Random Forests: An ensemble method that combines multiple decision trees to improve accuracy and reduce overfitting.

- Gradient Boosting Machines (GBM): GBM builds an ensemble of decision trees sequentially, with each tree correcting the errors of the previous ones.

Unsupervised Learning Approaches

Unsupervised learning algorithms do not require labeled data. They identify patterns and structures in the data to detect fraudulent activities. This approach is useful when labeled data is scarce or unavailable. Common unsupervised learning algorithms include:

- K-Means Clustering: This algorithm groups similar data points into clusters. Fraudulent activities may form distinct clusters due to their unusual characteristics.

- Hierarchical Clustering: Hierarchical clustering builds a hierarchy of clusters, allowing for the identification of fraudulent activities at different levels of granularity.

Implementing Machine Learning for Fraud Detection in Apps

Implementing machine learning for fraud detection involves several key steps. Firstly, it’s crucial to define the specific types of fraud you want to detect. Secondly, data collection, cleaning, and feature engineering are critical for building an accurate model. Lastly, model evaluation and continuous monitoring are necessary to maintain the effectiveness of the fraud detection system. Let’s delve into these steps:

Data Collection and Preparation

The quality of your data is paramount for building an effective machine learning model. Collect data from various sources, including transaction logs, user activity data, and device information. Clean the data to remove inconsistencies and errors, and then perform feature engineering to create relevant features that can help the model distinguish between fraudulent and non-fraudulent activities.

Model Training and Evaluation

Once the data is prepared, train your chosen machine learning model using a portion of the data. Evaluate the model’s performance using a separate validation dataset to ensure it generalizes well to new data. Metrics such as precision, recall, and F1-score can be used to assess the model’s accuracy.

Real-Time Monitoring and Adaptation

After deployment, continuously monitor the model’s performance and adapt it as needed. Fraudulent techniques evolve over time, so it’s essential to retrain the model periodically with new data to maintain its effectiveness. Real-time monitoring enables immediate detection of suspicious activities, minimizing potential losses.

Benefits of Using Machine Learning in Mobile App Security

The benefits of implementing machine learning in mobile app security are numerous and far-reaching. From enhanced detection accuracy to real-time threat prevention, machine learning offers a significant advantage over traditional fraud detection methods. Let’s look at the key advantages:

- Enhanced Detection Accuracy: Machine learning models can analyze complex patterns and relationships in data, enabling them to detect fraudulent activities with greater accuracy.

- Real-Time Threat Prevention: Real-time monitoring and detection capabilities allow for immediate intervention, preventing fraudulent transactions before they occur.

- Reduced Operational Costs: By automating the fraud detection process, machine learning can reduce the need for manual review, lowering operational costs.

- Improved User Experience: Minimizing false positives ensures that legitimate users are not inconvenienced, improving the overall user experience.

- Scalability and Adaptability: Machine learning solutions can easily scale to accommodate growing transaction volumes and adapt to evolving fraud techniques.

Addressing Challenges in Fraud Detection

While machine learning offers numerous advantages for fraud detection, it’s essential to be aware of the challenges and implement strategies to address them. Class imbalance, concept drift, and model interpretability are common issues that need careful consideration.

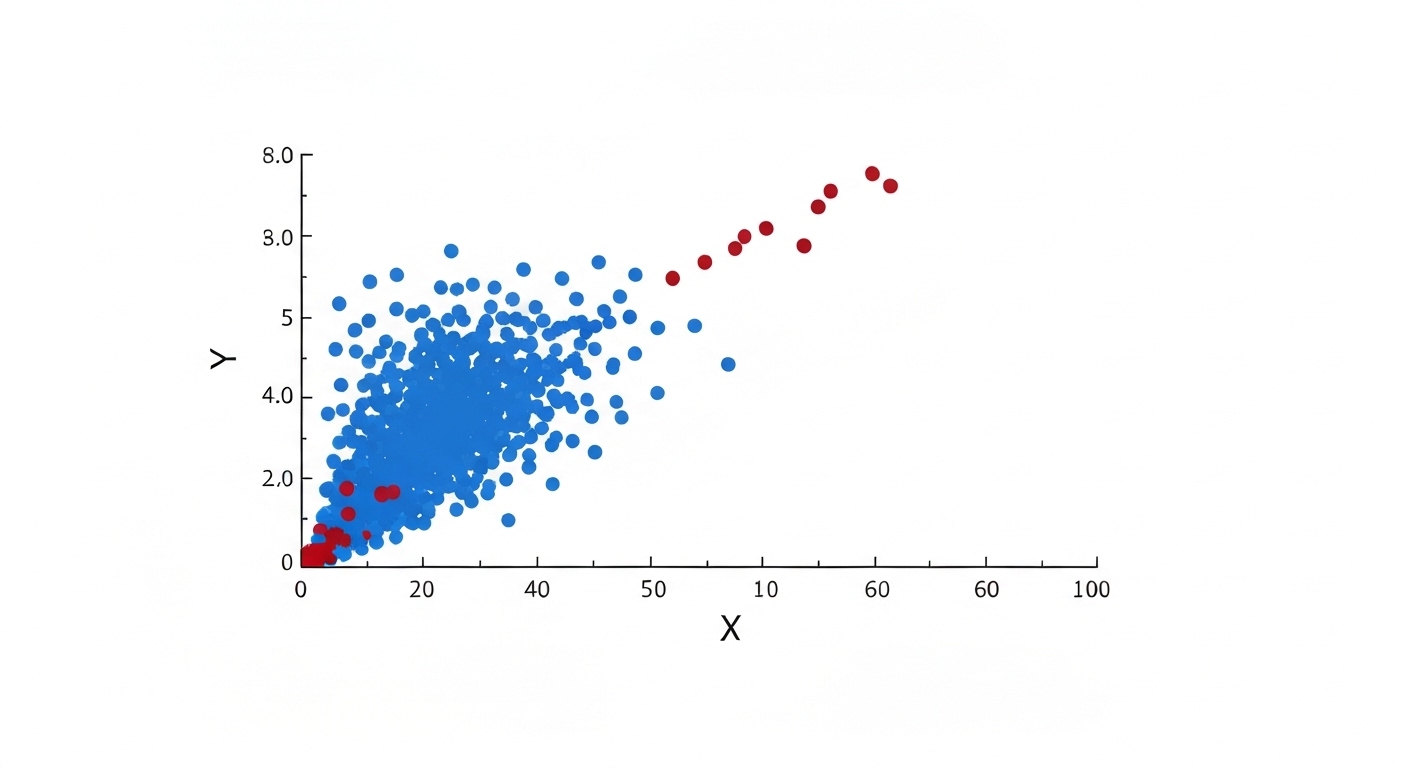

Class Imbalance

In fraud detection, the vast majority of transactions are typically legitimate, while only a small fraction are fraudulent. This class imbalance can bias machine learning models towards the majority class, leading to poor performance in detecting fraud. Techniques such as oversampling, undersampling, and cost-sensitive learning can help mitigate this issue.

Concept Drift

Fraudulent techniques evolve over time, causing the underlying data distribution to change. This phenomenon, known as concept drift, can degrade the performance of machine learning models. Regularly retraining the model with new data and using adaptive learning techniques can help address concept drift.

Model Interpretability

Understanding why a machine learning model makes certain predictions is crucial for building trust and ensuring accountability. However, some complex models, such as deep neural networks, can be difficult to interpret. Using explainable AI (XAI) techniques can help shed light on the model’s decision-making process.

The Future of Fraud Prevention Techniques with Machine Learning

The future of fraud detection is inextricably linked to the advancement of machine learning technologies. As algorithms become more sophisticated and data availability increases, machine learning will play an increasingly crucial role in protecting apps and users from fraudulent activities. Here are some emerging trends and future directions:

- Deep Learning: Deep learning models, such as recurrent neural networks (RNNs) and convolutional neural networks (CNNs), are increasingly being used for fraud detection due to their ability to learn complex patterns in data.

- Federated Learning: Federated learning enables machine learning models to be trained on decentralized data sources without sharing the raw data, enhancing privacy and security.

- Explainable AI (XAI): XAI techniques are becoming increasingly important for making machine learning models more transparent and interpretable.

- Graph Neural Networks (GNNs): GNNs are well-suited for analyzing relationships between entities, such as users and transactions, making them effective for detecting complex fraud schemes.

By embracing these advancements and continuously refining their fraud detection strategies, businesses can stay ahead of emerging threats and ensure the safety and security of their apps and users. For example, integrating behavioral biometrics can enhance fraud detection, as discussed on NIST.gov.

Furthermore, companies are increasingly leveraging cloud-based platforms for fraud detection due to their scalability and cost-effectiveness. Flash Cloud offers solutions to help companies detect fraud.

Conclusion

Machine learning for fraud detection in apps offers a powerful and effective solution for protecting users and businesses from fraudulent activities. By leveraging advanced algorithms, real-time monitoring, and continuous adaptation, machine learning can detect and prevent fraud with greater accuracy and efficiency than traditional methods. As technology continues to evolve, machine learning will play an increasingly important role in safeguarding the digital landscape and ensuring a secure and trustworthy experience for all app users. Embracing these advanced fraud prevention techniques will not only protect your business but also enhance trust and confidence among your user base.

HOTLINE

+84372 005 899